The Rise of Interest Rates: An Investor’s Perspective

- 09

- May

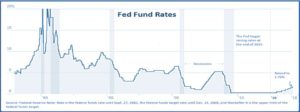

When reviewing the current environment for interest rates, almost all analysts are in agreement that they will continue to rise in the future. Short term interest rates, which in recent years were at historically low levels, have already risen. The Federal Reserve has already increased rates once this year, and at the end of a 2-day policy meeting, on May 2, the Federal Reserve decided unanimously to hold interest rates steady at the target range of 1.5 to 1.75%. Their notes said this decision was based on inflation recently moving close to the U.S. Central Bank’s target and that, “on a 12-month basis is expected to run near the Committee’s 2% objective over the medium term” (Reuters.com, May 2, 2018).

As suspected, during the May meeting, the new Federal Reserve Chairman Jerome Powell confirmed that they will continue a middle of the road approach to monetary policy and steadily increase rates. They are still on track to fulfill two additional rate increases, one in mid-June and one later this year. Most economists are confident the Fed will raise rates at the next meeting in June. However, some analysts feel that there is a possibility of two more raises after that one in 2018 (Associated Press, May 2, 2018).

Inflation Outlook

Inflation is at the center of the U.S. economy, because the Federal Reserve is closely monitoring whether consumer price increases will accelerate and force it to raise interest rates more sharply this year. Greg McBride of Bankrate.com stated, “The Fed pledges to maintain their gradual pace of rate hikes despite inflation moving close to their 2% objective, with some wiggle room for it to run slightly above that.” He also added that, “the movement in inflation will squarely shift the outlook to four rate hikes, rather than just three, by the time 2018 draws to a close.”

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, wrote in a research note after the meeting, “The Fed is telling markets that it won’t overreact to a run of higher numbers just as it didn’t overreact to the run of five straight downside surprises last year” (Source: www.nytimes.com, May 2, 2018).

The USA Today, reported on May 7th that, “Consumer credit has been growing solidly as strong job and income growth make Americans feel more comfortable about using their credit cards to make purchases. They also shared that unemployment is at a 17-year-low of 4.1%, and recently there has been a jump in gasoline prices. Just like the Fed, investors should keep a close eye on inflation.

U.S. Treasury Notes

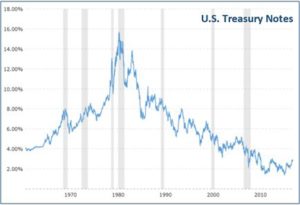

The 10-year U.S. Treasury’s stature as a benchmark comes from being perceived as risk-free. 3% by some economists is viewed as a key threshold for a number of reasons. Three main reasons are: mortgage rates, the stock market and corporate debt. If this rate goes up, it will increase new mortgage rates. Also, if corporate borrowing becomes more expensive, that could lead to corporate projects or expansion being put on hold or cancelled.

The 10-year U.S. Treasury yield on Tuesday, May 1, moved above 3% for the first time since 2014. It’s a psychological level for the markets because we haven’t seen 3% 10-year yields since 2013. “The 10-year is potential competition for stocks,” said David Kass, a professor of finance at the University of Maryland (Fidelity.com, May 2018, www.Macrotrends.net).

“The majority of the rise in Treasury yields so far this year appears to have been due to changes in expectations for interest rates… Investors are now counting on faster Fed tightening than previously, which makes sense given the signs that core inflation and wage pressures in the US have increased,” said Oliver Jones, Market Economist for Capital Economics (SMarketwatch.com, May 1, 2018).

Remember, while interest rates are up from a year ago, they are still at historically lower levels. 6% is the 60-year average for a 10 Year Treasury (Barron’s, May 5, 2018).

The Relationship Between Interest Rates and Bond Prices

Yield is a simple concept. It is the current income return you receive when, for instance, you own a bond, as measured by a percentage. If the bond you bought for $1,000 pays you $30 per year — that’s a 3 percent annual yield.

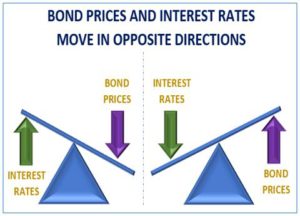

Typically, bond prices and interest rates move in opposite directions. This means that when interest rates rise, bond prices tend to fall, and conversely, when interest rates decline, bond prices tend to rise.

Here’s an example:

Suppose you invest $10,000 in a 10-year U.S. Treasury bond with a 3% yield. That interest rate is fixed, even as prevailing interest rates change with economic conditions—especially the rate of inflation. After five years, you decide to sell the bond, but interest rates have risen and similar new bonds are now paying 4%. Obviously, no one wants to pay $10,000 for a bond yielding 5% when a higher-yielding bond costs the same. So, the bond’s value has decreased.

When interest rates decrease, the reverse happens. If interest rates had fallen and new Treasury bonds with similar maturities were yielding 2%, you could most likely sell your 3% bond for more than your purchase price. When evaluating your bond related investments an important piece of information is a statistic known as “duration.” In finance, the duration of a financial asset that consists of fixed cash flows, like a bond, is the weighted average of the times until those fixed cash flows are received.

Duration also measures the price sensitivity to yield, the percentage change in price for a parallel shift in yields. Simply said, the longer the duration, the more sensitive a bond is to changes in rates.

Interest rate risk can be simplified by the following statement: when interest rates rise, bond prices fall; conversely, when rates decline, bond prices rise. Therefore, the longer the time to a bond’s maturity, the greater its interest rate risk.

Many investors often put a high percentage of their portfolios in bonds for income or to hopefully generate more stable types of returns. This holds especially true when they are very worried about the economy or other financial issues, or after they have taken a beating in stocks. Unfortunately, in a rising interest rate environment, that logic could present problems.

Four Recommendations to Consider for Investors

- Maintain complete liquidity for all short-term and near-term needs. Liquid accounts in today’s interest rate environment will probably not keep pace with inflation. Although it is always important to maintain a liquid component in your portfolio, you should think about what major expenses you will incur in the next two years and consider keeping a larger than typical liquid pool of assets.

- Choose shorter terms over high yields. Although shorter term bonds yield less than longer term bonds, they typically lose less value when rates rise.

- Review all of your income-producing investments. As wealth managers, we help our clients review their income-producing investments. Our primary goal is to match your portfolio to your timelines and personal financial situation.

- Monitor your portfolio regularly. Interest rates can move quickly or slowly. We stay apprised of the Fed and its decisions on interest rates so we can suggest adjustments to your portfolio as needed in a timely and educated manner.

Closing Thoughts

Interest rate risk can be complex. Take, for example, the nuances to reviewing duration, including how to compare the different types of bonds, like investment grade corporate bonds and treasuries. Just because they have the same level of duration, this does not mean that any two bonds will respond identically to interest rate changes. In the case of corporate bonds, their prices are also influenced by the credit quality of the company.

This is where we can help. When overseeing the investments, we recommend to clients, we take economic growth and rising interest rates into consideration.

In today’s interest rate environment, a review from a qualified financial advisor can prove to be productive exercise. We are proud of the research we do on our clients’ behalf and are always willing to offer a “complimentary” financial review for your friends and associates.

Discuss Any Concerns with Us

If you have any questions, please do not hesitate to ask them. We are always available to review your investment portfolio with you. We will always consider your feelings about risk and the markets and review your unique financial situation when providing any recommendations.

We pride ourselves in offering:

- consistent and strong communication,

- a schedule of regular client meetings, and

- continuing education for members of our team on the issues that affect our clients.

A good financial advisor can help make your journey easier. Our goal is to understand our clients’ needs and then try to create plans to address those needs. While we cannot control financial markets, inflation, or interest rates, we keep a watchful eye on them. We can discuss your specific situation at your next review meeting or you can call to schedule an appointment. As always, we appreciate the opportunity to assist you in addressing your financial matters.

Please share this report with others!

This year, our goal is to offer services to several other clients just like you! If you would like to share this report with a friend or colleague, please click on the sharing icons at the top of the article.

Financial Advisors Network, Inc. is a registered investment advisory firm.

Note: This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer or financial professional.

The views stated in this letter are not necessarily the opinion of Financial Advisors Network, Inc., and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. © Sources: (reuters.com, Associated Press, NYTimes.com, Fidelity.com, MarketWatch.com, Macrotrends.com; USATodayw) Contents provided by the Academy of Preferred Financial Advisors, Inc.

- Financial Advisors Network Customer Service

- Uncategorized

- Comments Off on The Rise of Interest Rates: An Investor’s Perspective