1st Quarter Newsletter

- 03

- May

The first quarter of 2023 had investors sitting on the edge of their seats as the equity markets took them for a bumpy ride. In the end, the quarter did close on a good note, with U.S. stocks having a late-quarter comeback following some positive news that the Federal Reserve’s preferred inflation gauge took a dip in February after an uptick in January. The core personal consumption expenditures price index (PCE) (excluding food and energy) increased 4.6% in February from a year earlier, slowing from a 4.7% 12-month annual pace in January. It was up 0.3% from January, compared with a 0.4% increase that was originally expected by economists. This was a welcome sign that the Fed is gaining traction in its long battle against inflation (barrons.com, 3/31/2023).

The first three months of 2023 were a classic example that volatility can be very prevalent in equity markets. Despite a banking crisis, an initial uptick in inflation rates, additional increases in interest rates and economic uncertainty, U.S. equities still managed to end the quarter on a high note.

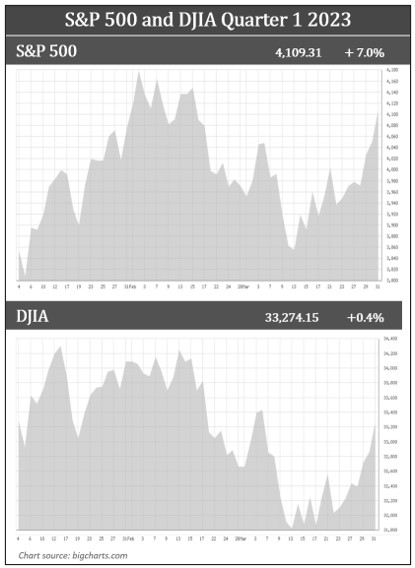

The Dow Jones Industrial Average (DJIA) ended the quarter up 0.4%, after rising 3.2% in the last week of the quarter, its largest one-week gain since the week ending November 11, 2022. The DJIA closed on March 31, 2023, at 33,274. The S&P 500 rose 7.0% during the first quarter, which is its best three-month performance since the fourth quarter of 2021. The S&P 500 closed the quarter at 4,109 (cnbc.com, 3/31/23).

Despite the first quarter’s strong performance, inflation rates remain at levels still well above the Fed’s 2% target range. The U.S. annual inflation rate was 6.0% for the 12 months ending February 2023, following a rise of 6.4% in the previous period, according to U.S. Labor Department data published March 14, 2023. Declaring victory and lowering interest rates now could prove to be too soon. Key indicators for the Fed are still showing strong, including the unemployment rate, which is at a 50-year low of 3.4%.

To sum it up, in the first quarter of 2023, growth was modest, job gains increased at a strong pace, and unemployment remained low. While inflation is showing signs of slowing, it remains elevated and still poses a threat. With additional monetary policy changes and signs of slowing growth, it is safe to say that volatility should continue into the second quarter.

“Although inflation has been moderating in recent months, the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy,” Fed Chairman Powell stated during a testimony before the Senate Banking Committee in early March. The next FOMC meeting is set for May 2-3 and another possible rate hike could be enacted (npr.org, 3/7/2023).

Equities are most likely to continue to remain hypersensitive, surging on positive news days, and retreating when negative economic data is released. Most experts agree that stocks are currently undervalued and we will need to see leading economic indicators satisfy the Fed’s parameters before seeing a move toward more fair values. We continue to abide by our belief that investing is a long-term commitment and can provide a better safety net than short-term trading and investing. As your financial professional, we are committed to keeping you apprised of any changes and activity that could directly affect you and your unique situation.

Inflation & Interest Rates

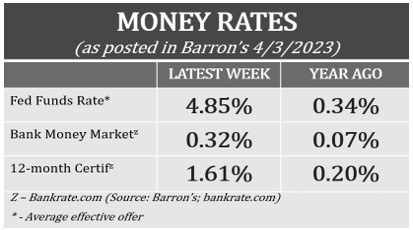

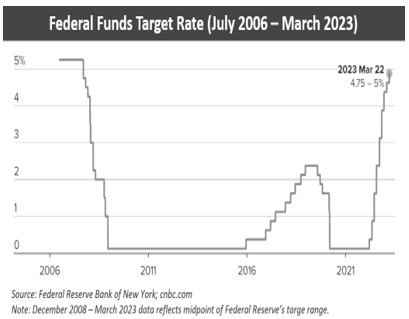

Inflation peaked in the summer of 2022 and since then, has primarily been on a downward trend but is still not close to the Feds target rate of 2%. The bad news is the Fed continued increasing the federal interest rate range in the first quarter of 2023. The good news is the rate at which they increased the range was not as steep as last year’s rate hikes. On February 1, we saw a 0.25% increase, bringing the interest rate range to 4.50 – 4.75%. Then again, in March, the rate was increased by another 0.25%, to a range of 4.75 – 5.00%. The Federal Reserve still expects to bring the interest rates to 5.1% by the end of 2023, which means that they expect one more rate hike before they pause. Today’s rates are currently at the highest level since September 2007.

In the Fed’s quest for price stability, the March increase represented the ninth-rate hike since March 2022, when the rate range was only 0.25 – 0.50%.

With inflation slowly starting to show some signs of improvement, we may see the Fed stop raising interest rates at some point in 2023. We are close to the median projection among Fed officials for a final interest rate target range. With inflation at 6.0% in February, down from 6.4% in January and down 3.1% from the record high of 9.1% in June of 2022, it appears that the Fed is finally making progress. However, Fed Chair Jerome Powell is still carefully watching key economic indicators in addition to unemployment rates, including personal consumption expenditures (PCE), and consumer price index (CPI). In their Press Release follow the March FOMC meeting, it stated, “The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments” (federalreserve.com, 3/22/2023).

Previously, Fed Chair Jerome Powell stated at the FOMC’s February post-meeting press conference, “We’re going to be cautious about declaring victory and sending signals that we think the game is won” (bankrate.com 2/7/2023).

The silver lining of these higher interest rates is certificate of deposits and even savings accounts are yielding some of the best returns investors have seen in a long time. It is now not unusual to see some banks offering over 4% with CDs.

We are closer to the end of a Fed hiking cycle than the beginning. However, there still could be some tightening in the near future. The Fed will continue to monitor information and key indicators before they stop the cycle. Currently, Chair Powell stated that, “rate cuts are not in our base case” for the remainder of 2023 (cnbc.com, 3/22/2023).

As your financial professional, we are committed to keeping a vigilant eye on all aspects of financial planning that may affect you, including interest rates and inflation. If you’d like to know how these may affect your portfolio, please contact us to discuss any strategies that may help combat the effect on your personal situation.

The Bond Market & Treasury Yields

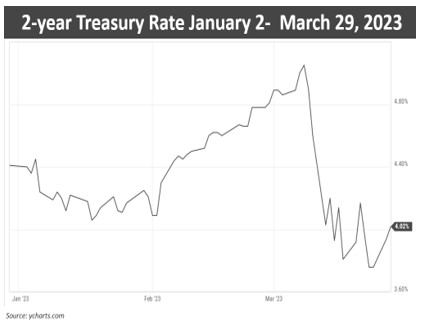

Treasuries took a hit when the shutdown of Silicon Valley Bank, the biggest bank failure since the financial crisis, triggered many investors to run for cover in safer assets, such as government bonds. On the Monday after the Silicon Valley Bank collapse, the 2-year Treasury yield posted its biggest 3-day drop since the aftermath of the 1987 stock crash on October 22, 1987. The benchmark 10-year Treasury note yield fell, settling at 3.543%. Despite all of this, bond prices rose as investors are suspecting the Federal Reserve will not raise rates as high as previously expected due to the banking crisis (cnbc.com., 3/13/23).

Treasuries are yielding favorable returns in this high interest rate environment, but the recent wavering was a good reminder that things can take a turn at any moment. Yields move inversely to prices and one basis point equals 0.01%. In the month of March, the 2-year rate traded in a very widespread range of more than 150 basis points.

Volatility has been very prevalent in what is typically a less volatile sector for investors. Bonds are typically a good option for a conservative, diversified, and well-balanced portfolio as they are usually more stable than stocks. The window of opportunity may be narrowing to get lower-risk, higher yielding bonds if the Feds decide to cut rates, as bond prices and interest rates move in the opposite direction.

If you’d like to explore how bonds could fit into your retirement income strategy, please contact us so we can help you make the best decision for your portfolio. Please remember, while diversification in your portfolio can help you reach your goals, it does not ensure a profit or guarantee against loss. We will continue to monitor how the Fed’s movements and rising interest rates are affecting bond yields.

Investor’s Outlook

It’s fair to say that the first quarter of 2023 was filled with ups and downs. In January, we saw a decent upward trend in equities, primarily as a result of the prospect of future rate hikes to be slower or better yet, paused and then pivoted to easing, in the near future.

Then in February, the Fed’s raised rates by .25%. Equity markets responded unfavorably to the announcement. Then in March, we saw another rate increase and a brand-new surprise when three major financial institutions, Silicon Valley Bank, Signature Bank, and Credit Suisse, collapsed. This triggered more market instability and uncertainty. But somehow, the quarter still ended on a positive note. Some analysts are saying that the market’s show of resilience despite facing a constant barrage of bad news could reflect the positive sentiment investors have about the near future.

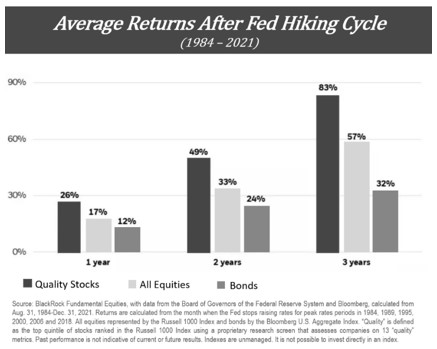

What will the next quarter and beyond bring for investors? The past few years have taught us that it’s a better practice to expect the unexpected and be prepared for anything the economic environment throws at investors, rather than trying to predict the future of equity markets. No one can predict what the future holds. Our goal as your financial professional is to not try to predict the future but provide you with a solid financial plan that is designed to best weather any market environment. While past performance is not a guarantee of current or future results, history shows us that returns from equities after a recession have been fruitful.

The Fed still has its eye on their goal of a 2% inflation target. Most Fed officials are anticipating one more rate increase in 2023. Three anticipate two more rate hikes, another three project three more, while only one policymaker thinks four more hikes will happen in 2023, and one official projecting none. This confirms that even amongst Fed officials there is no consistency! The Fed will continue to watch key economic indicators, including inflation rates, unemployment rates, and personal consumption expenditures. The collapse of sizable banks has created another element of concern for the Feds. In response through the FOMC’s press release on March 22, 2023, they stated that they believed the, “U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks” (bankrate.com. 3/29/2023, federalreserve.com, 3/22/2023).

We stand by our belief that investing in equities is a long-term commitment. Investors can expect to continue to face a challenging market environment and the need to look at long-term stability and quality, practicing patience, and proceeding with caution are key to your financial savviness. As the chart in the newsletter shows, the average return after a Federal Reserve hiking cycle ends can be rewarding.

As we continue into the second quarter of 2023, we will continue to monitor your advisory portfolios with a special focus on these three key areas:

- Inflation rates

- Economic growth rate

- Tightening of monetary policy

We still advise keeping a long-term mindset. The coming months could be filled with uncertainty and more market volatility. Keeping your head down and your eyes and ears away from media magnification can help you as we enter into the next quarter. Smart investing includes having a long-term mindset and staying the course of your well-devised and balanced financial plan. Loss aversion can be a powerful motivator for investors to sell their stocks. However, as you may know, trying to time the market to reinvest is a very tricky game and can prove to be costly.

On troublesome days, it can be helpful to avoid too much exposure to the media and the news. News reports and headlines are largely intended to incite fear and ruffle the feathers of even the calmest of investors. Media magnification can cause anxiety and even cause investors to make emotionally charged decisions, which typically are not the wisest.

Don’t forget to continue to pay down any debt that you may have and try not to incur any more during the higher interest rate environment. It is always wise to live within your means and minimize any borrowing, but it is recommended now more than ever.

Also, while high inflation may have put a crimp in your savings goals, consistently adding to your savings should be another priority. We are happy to discuss all offerings with you including savings and checking accounts and Certificate of Deposits with decent yields.

Our goal as the steward of your wealth is to help you through uncertain times like these. We always attempt to help you create a well-crafted plan customized for your unique situation and goals that takes into consideration how you will react to the market’s ups and downs, including your time horizon, tax implications, liquidity needs, risk tolerance, and your overall personal objectives.

We take pride on offering our clients first class service that includes:

- A proactive, individually tailored approach to each client’s financial goals and needs.

- Consistent and meaningful communication throughout the year.

- A schedule of regular client meetings.

- Continuing education for all our team

members on issues that may affect our clients. - Proactive planning to navigate the changing environment.

We always recommend discussing with us any changes, concerns, or ideas that you may have prior to making any financial decisions so we can help you determine your best strategy. There are often other factors to consider, including tax ramifications, increased risk, and time horizon changes when altering anything in your financial plan.

Remember, a skilled financial professional can help make your financial journey easier. Our goal is to understand your needs and create an optimal plan to address them.

Financial Advisors Network, Inc. is a registered investment advisory firm. Advisory services are only offered to clients or prospective clients where Financial Advisors Network, Inc. and its representatives are property licensed or exempt for licensure. No advice may be rendered by Financial Advisors Network, Inc. unless a client service agreement is in place. The views stated in this letter are not necessarily the opinion of Financial Advisors Network, Inc, and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 1000 Index consists of the 1,000 largest securities in the Russell 3000 Index, which represents approximately 90% of the total market capitalization of the Russell 3000 Index. It is a large-cap, market-oriented index and is highly correlated with the S&P 500 Index. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk. Sources: www.cnbc.com; www.usatoday.com; www.reuters.com; www.barrons.com; www.usinflationcalculator.com; www.forbes.com; www.blackrock.com; www.bankrate.com; www.cnbc.com; www.fool.com; www.britannica.com; www.schroders.com; www.npr.com; www.bigcharts.com; www.federalreserve.com; Contents provided by the Academy of Preferred Financial Advisors, 2023©

- Financial Advisors Network Customer Service

- Articles

- Tagged with : Financial Services, Market Volatility

- Comments Off on 1st Quarter Newsletter